Loya Insurance Company

25+ Years of Trusted Service *

Call us 855-620-9443

25+ Years of Trusted Service *

Applying for auto insurance once involved complex negotiations and confusing jargon, but technology has simplified the process. Today, you can compare providers and request quotes online in minutes. However, many drivers still value face-to-face interactions for trust and clarity. Fred Loya Insurance combines modern convenience with personalized service, offering accessible coverage through over 700 offices and an online platform. Learn more at loyalinsurance.org.

Fred Loya Insurance maintains a traditional, customer-focused approach, with strategically located offices in public spaces like department stores, street corners, and commercial buildings. As of 2025, they operate in states including Texas (headquarters), Alabama, Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, New Mexico, Nevada, and Ohio. This accessibility fosters direct communication, allowing customers to ask questions, file claims, or apply for coverage in person. For office locations, visit the Fred Loya Locations page.

For first-time buyers, understanding the application process is key to avoiding delays. Fred Loya simplifies this with a straightforward approach, requiring minimal information and offering near-guaranteed approval. Here’s how it works:

Unlike many insurers, Fred Loya doesn’t require credit scores or DMV records, making approval easier.

For more details, check the Fred Loya Application page.

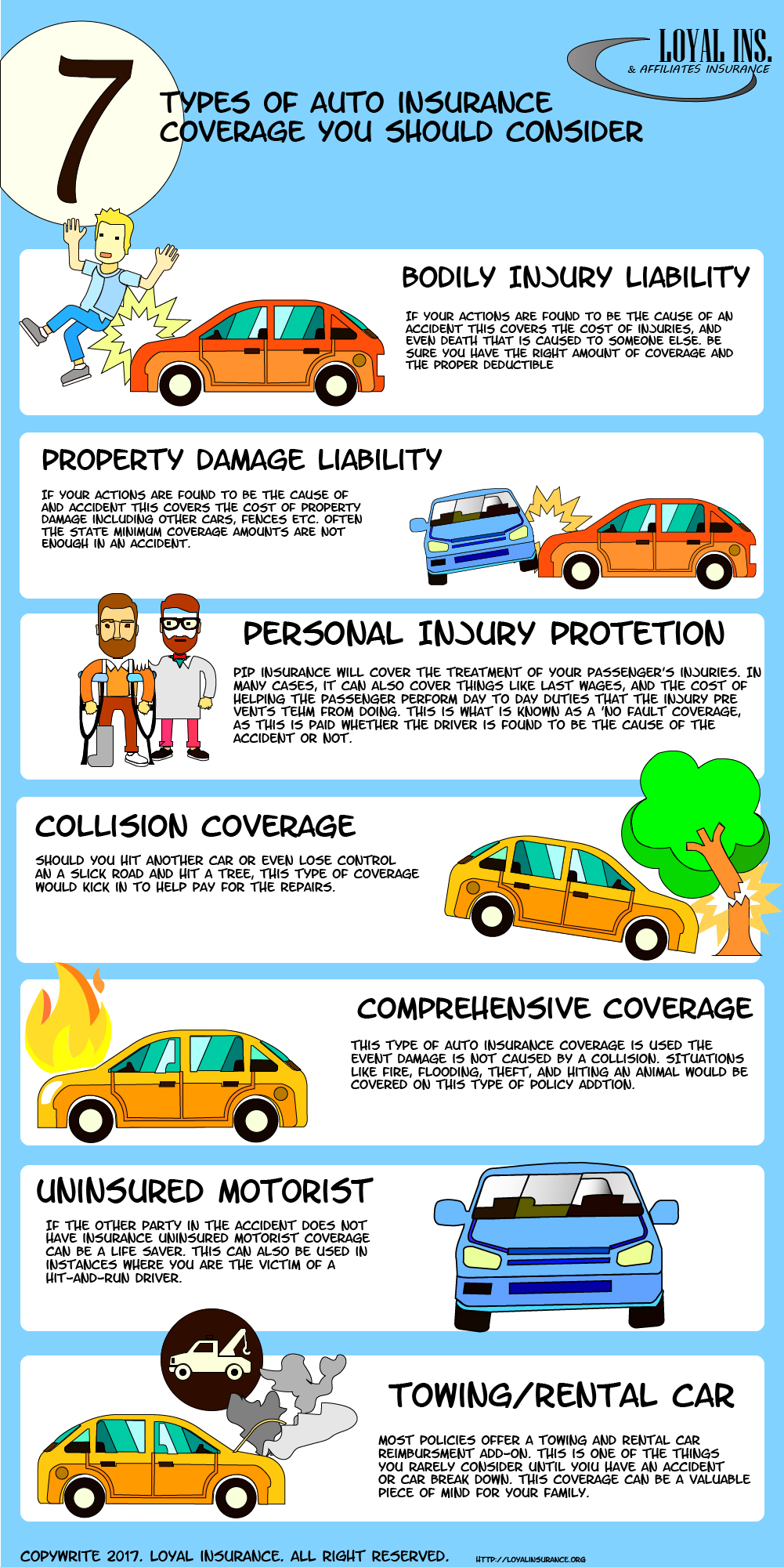

Every state mandates minimum auto insurance, typically including liability and personal injury protection (PIP). Fred Loya offers these and optional coverages to enhance protection:

| Coverage Type | Description |

|---|---|

| Liability | Covers damages to others if you’re at fault in an accident. |

| Personal Injury Protection (PIP) | Pays for medical expenses for you and your passengers, regardless of fault. |

| Comprehensive | Protects against non-collision damages like theft, vandalism, or natural disasters. |

| Collision | Covers accident-related repairs to your vehicle, regardless of fault. |

Consult your local DMV for state-specific requirements or explore options on the Fred Loya Coverage page.

First-time buyers can streamline their application by avoiding these pitfalls:

Working with a Fred Loya agent ensures you select the right coverage without overspending.

Fred Loya excels in accessibility and inclusivity, approving most applicants regardless of past accidents or credit history. Their non-standard policies cater to high-risk drivers, and in-person consultations build trust. With flexible coverage options and offices in convenient locations, Fred Loya balances modern convenience with personalized service.

Fred Loya Insurance makes auto coverage simple, affordable, and approachable, whether you prefer online quotes or in-person support. Their streamlined application process, minimal requirements, and extensive office network make them a top choice for drivers in 2025. Start your application at loyainsurance.org or learn more on the Fred Loya Insurance Wikipedia page.