Find good rates at Fred Loya Auto Insurance

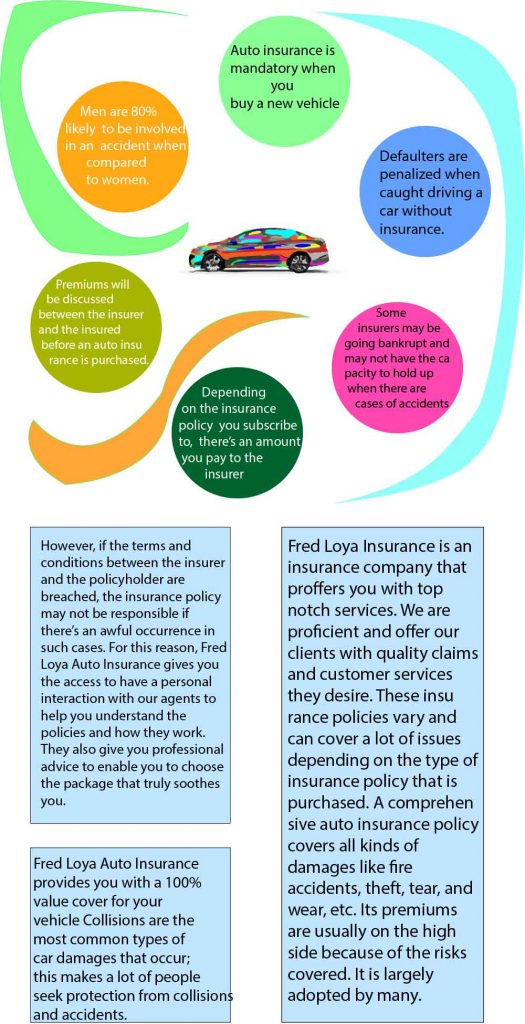

Vehicles play a major role in our daily lives as its necessity is just undeniable. Auto insurance is mandatory when you buy a new vehicle, and you need to register your vehicle. State laws are very strict with this; it binds on every vehicle moving on the roads. It is a must that every car is insured and covered by an insurance policy with an auto insurance company. Defaulters are penalized when caught driving a car without insurance. These penalties can range from having your car impounded, having your license and registration suspended or being booked with a huge ticket.

So there are a lot of people trying to get a good coverage for their vehicles, and there also are a lot of insurance companies out there – but you are lucky to be here.

A lot of factors are considered when it comes to discerning an excellent insurance company. It can be tricky, but you need to pay more attention to certain factors such as the financial capacity of the insurer, the cost of their policies, other benefits that they offer which may be peculiar to the insurance company alone. Some insurers may be going bankrupt and may not have the capacity to hold up when there are cases of accidents they may not be able to meet up to expectation. A subscriber, who has been faithful with his premiums, will be disappointed if he can’t get a speedy bail out from his insurer for the awful event.

Fred Loya Auto Insurance has a valid license to operate and sell awesome insurance policies to its customers

Depending on the insurance policy you subscribe to, there’s an amount you pay to the insurer. This payment is called a premium, and it is paid in installments or annually depending on the terms of the insurer. Premiums will be discussed between the insurer and the insured before an auto insurance is purchased. Men usually pay more when it comes to rates because it is proven statistically that; men are 80% likely to be involved in an accident when compared to women. Teenagers are also considered to be in the high-risk radar. In some cases, these rates can be reduced if the teenager takes a defense driving course and gets certified.

An auto insurance policy covers the policyholder or any other persons who uses the vehicle too. However, if the terms and conditions between the insurer and the policyholder are breached, the insurance policy may not be responsible if there’s an awful occurrence in such cases. For this reason, Fred Loya Auto Insurance gives you the access to have a personal interaction with our agents to help you understand the policies and how they work. They also give you professional advice to enable you to choose the package that truly soothes you.

Fred Loya Insurance is an insurance company that proffers you with top notch services. We are proficient and offer our clients with quality claims and customer services they desire. These insurance policies vary and can cover a lot of issues depending on the type of insurance policy that is purchased. A comprehensive auto insurance policy covers all kinds of damages like fire accidents, theft, tear, and wear, etc. Its premiums are usually on the high side because of the risks covered. It is largely adopted by many.

Fred Loya Auto Insurance provides you with a 100% value cover for your vehicle

Collisions are the most common types of car damages that occur; this makes a lot of people seek protection from collisions and accidents. Loya’s Insurance collision policy covers your vehicles from all sorts of damages related to collisions. If you consider the huge cost of putting an accident car back in shape you should consider subscribing to Fred Loya Auto Insurance for collision incidents.

Liability insurance covers for the damage on another person’s vehicle and also injured victims of an accident. This policy is very important for those who can’t afford the bills for damages. The minimum coverage a person can have under the liability insurance is determined by the State laws using different factors as a determinant. If you have kept a good driving record, you will be enjoying a less premium. Under the third party insurance, some case like injuries, damages occurred from carrying goods, damaged items belonging to the driver, etc. are not covered.

A full auto insurance coverage is a combination of the collision, comprehensive and liability insurance policies

With the full auto insurance coverage, a whole lot of responsibilities are bestowed on the insurance company. Additional responsibilities such as medical expenses are covered even if you are the one who is faulty.

When vehicles are sold to a different user, the third party liability insurance, and the comprehensive car insurance policies will still cover the new user for a period of time (usually 3 weeks) after ownership has being changed. Vehicles meant to be sold but are still in the possession of companies are not covered in cases were damages occur. Another important thing to note regarding auto insurance is the deductibles which are based on the agreement in the auto insurance policy.

Deductibles are deducted only once in cases of an insurance event involving both third party liability and damages under the comprehensive auto insurance. In most cases, the duration for insurance policies is 1 year and afterward renewed. The duration is based on the agreement between the insurer and the insured. However, the insured can terminate the contract by writing or the company giving a month notice.

Get additional information at Wikipedia about Fred Loya Auto Insurance